The Federal Reserve at an Inflection Point:

The Federal Reserve at an Inflection Point: Leadership, Rates, and What It Means for Investors

As we begin 2026, the Federal Reserve is entering what may be its most transformative year in a decade. With Jerome Powell’s term as Chair set to expire this May, the "Fed factor" has once again become the primary driver of market sentiment and portfolio strategy.

For investors, particularly those focused on preserving and compounding wealth across market cycles, understanding these dynamics is critical.

Below, we outline what may lie ahead for the Fed, how markets are interpreting its next moves, and why these decisions matter for portfolio positioning.

The Powell Succession: Who Is on the Shortlist?

Jerome Powell’s term as Chair of the Federal Reserve is set to expire on May 15, 2026, setting the stage for a potential leadership change at a pivotal moment. While Powell could be reappointed (highly unlikely), markets are starting to think about what comes next. Expectations are mounting for President Donald Trump to nominate Powell’s replacement soon--as early as this month. Trump has expressed a strong desire for lower interest rates and is reportedly considering candidates who are in line with this view, causing concerns about the FED’s independence in the future.

The White House has already signaled a shortlist of potential successors. The names currently leading the conversation include:

Kevin Hassett: Current Director of the National Economic Council. He is viewed as a pro-growth economist who has expressed openness to more aggressive rate cuts to support the economy.

Kevin Warsh: A former Fed Governor with deep ties to the financial sector. He is on shortlists for Chair given Treasury and policy experience. Warsh is often viewed as a "hawk" on inflation but has recently argued that a smaller Fed balance sheet could actually allow for lower interest rates.

Christopher Waller & Michelle Bowman: Both are current Fed Governors. Choosing an internal candidate would likely signal "continuity" to the markets, reducing potential volatility during the handover.

Powell has been a steady hand — not ideological, not dramatic — and markets generally like that and prefer predictability. A change in leadership could bring a change in "regime."

Markets are currently trying to price in whether a new Chair will be more "dovish" (favoring lower rates to help growth) or "hawkish" (favoring higher rates to curb inflation).

Any leadership change that signals a material shift could introduce short-term volatility.

Yield Curve Signals

The yield curve (the spread between longer-term and shorter-term Treasury yields) remains one of the most reliable indicators of market expectations.

When longer yields exceed short-term yields (normal curve), markets expect growth and stable inflation. When the curve inverts (short rates higher than long rates), it historically signals slower growth or recession.

Today’s curve reflects several important themes:

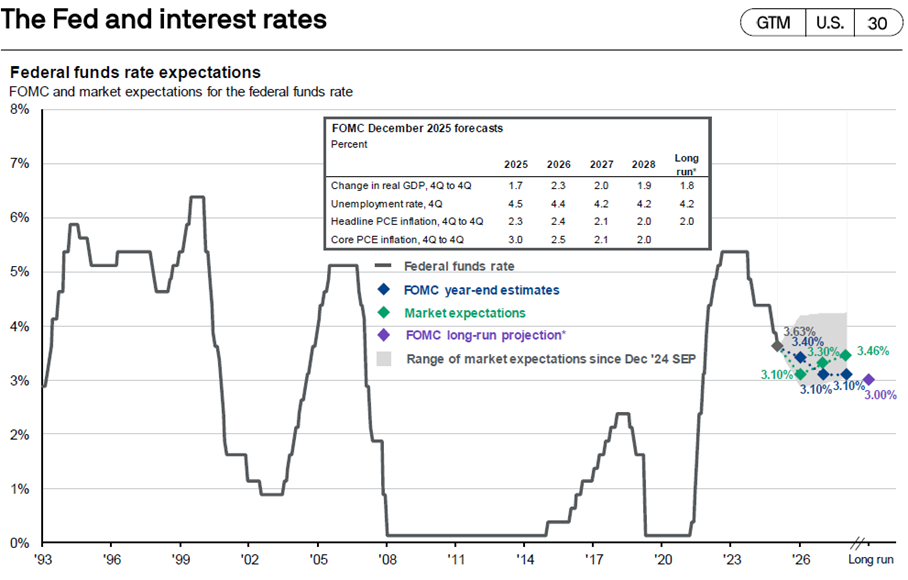

1. Short-term rates are expected to decline modestly over the next 12–24 months; consensus expects one or two cuts this year, but the Fed will remain data-dependent. After a series of cuts in late 2025, the Federal Funds Rate currently sits in the 3.50%–3.75% range. The terminal (long-run) neutral rate likely around 3.0%–3.25%, per projections aligned with market pricing.

2. Longer-term rates are staying relatively stable, suggesting expectations for moderate growth and contained inflation. The 10-year Treasury yield is staying around 4.0%.

3. Investors don’t expect a return to near-zero rates anytime soon; in other words, this isn’t a “rates are collapsing” story. It’s more of a slow normalization.

Inflation vs. Employment: The Fed’s Ongoing Balancing Act

The Fed has a dual mandate: keep inflation under control (around 2%) and support employment (maximum sustainable employment).

Inflation has moderated, but pressures remain above target in some measures — leading the Fed to be cautious about pace of cuts.

Core PCE is hovering around 2.7%. It is no longer a "crisis," but it remains stubbornly above the 2.0% target, largely due to housing and service costs.

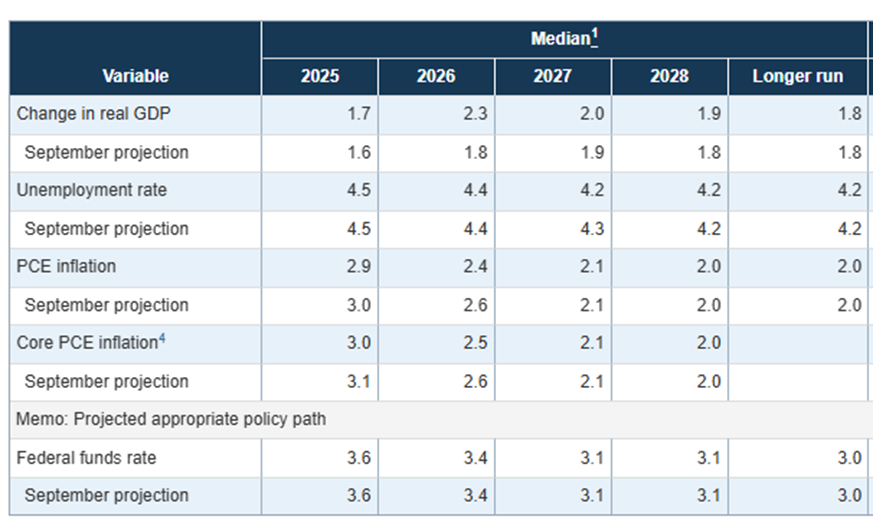

Inflation (PCE) is forecasted at 2.4% for 2026, with core PCE at 2.5%.

Labor markets have softened, with slower job growth contributing to recent rate decisions. The unemployment rate has edged up to 4.5%–4.6%. While not a "recessionary" level yet, the cooling labor market is the primary reason the Fed is comfortable cutting rates. The Fed projects unemployment rate at 4.4% for 2026, and to moderate to 4.2% in 2027.

The Fed is closely watching whether unemployment rises faster than expected and whether inflation consistently moves toward the 2% target before moving more aggressively.

They are trying to thread a needle. They don't want to cut rates too fast, and inflation could reaccelerate or wait too long, and risk economic growth could slowing.

This is why policy decisions now feel incremental and cautious. The Fed isn’t in a rush — and that’s intentional.

The Fed is unlikely to rush into aggressive rate cuts and declare victory on inflation prematurely.

How the Fed Actually Makes Decisions

The Federal Reserve isn’t one person making calls behind closed doors. Interest-rate decisions are made by the Federal Open Market Committee (FOMC), which includes:

1. Board of Governors: Seven members appointed by the President and confirmed by the Senate.

2. 12 Regional Federal Reserve Banks: Presidents of these banks participate in policy decisions.

3. Federal Open Market Committee (FOMC): The policymaking group that sets interest rates.

Only 12 people vote at any given meeting. This includes the seven Governors, the New York Fed President (permanent), and four other regional presidents who rotate every year

Each FOMC member has one vote on interest rate decisions and policy actions. The Chair of the Fed presides over the FOMC. This means all sitting members’ views matter — and changes in membership can shift the balance of decision-making.

The 2026 Voting Power: Watch the Hawks

The four regional presidents joining the voting rotation this year are:

1. Neel Kashkari (Minneapolis): A former dove turned hawk who has been vocal about the "resilience" of the economy justifying higher rates.

2. Lorie Logan (Dallas): A specialist in balance sheet mechanics who is famously cautious about cutting rates too early.

3. Beth Hammack (Cleveland): A newcomer to the voting circle with a deep background in market structure.

4. Anna Paulson (Philadelphia): Expected to maintain a balanced, data-dependent stance.

The takeaway: Even if a "dovish" Chair is appointed soon, they will face a committee that is currently more concerned about inflation "stickiness" than their 2025 predecessors were.

Balance Sheet Policy: The Quiet but Powerful Lever

Interest rates get the headlines, but the Fed’s balance sheet often has a bigger impact on liquidity and markets.

Here’s something that matters more than most people realize.

For the last few years, the Fed was shrinking its balance sheet (Quantitative Tightening or QT)— slowly pulling money out of the financial system.

After the pandemic, the Fed ran an expanded balance sheet (~$8–9 trillion). From 2022 through late 2025, it reduced its holdings by over $2 trillion to tighten liquidity.

That was a headwind for markets.

As of December 1, 2025, the Fed ended QT, stopping net reductions and stabilizing reserve levels.

The Fed isn’t aggressively pumping money back in, but it’s also no longer draining liquidity. Think of it as the Fed stepping off the brake.

Why It Matters to Markets

1. Reduced liquidity withdrawal lowers stress in funding markets

2. Credit spreads tend to stabilize

3. Risk assets often respond favorably to a neutral or expanding balance sheet

Historically, markets tend to behave better when liquidity is stable. This doesn’t mean straight-up returns — it just removes a headwind.

Final Thoughts

The Fed is no longer slamming on the brakes, but it isn’t hitting the gas either.

Rates are likely to drift lower; leadership may change, and liquidity conditions are stabilizing. That creates a more balanced, less extreme environment — one where thoughtful planning and risk management matter more than market timing.

As always, we’re focused on helping clients navigate these shifts with clarity and confidence.

Sources:

(1) Federal Reserve

(2) JP Morgan Asset Management