Economic Outlook 2026: What to Expect in the Year Ahead

Economic Outlook 2026: What to Expect in the Year Ahead

As 2025 draws to a close, many investors are asking what the shifting economic landscape could mean for their portfolios and long-term financial plans. Recent economic data highlights resilience across the economy, even amid periods of uncertainty.

We look to 2026 with cautious optimism.

Here are the key themes our team is watching for the year ahead:

Recession Risks: What Are the Odds?

While a full-scale recession is not the current consensus forecast, recession risks have increased amid softening labor markets, as reflected by a gradual rise in the U.S. unemployment rate and an uptick in corporate layoff announcements. Several major forecasters estimate that the probability of a mild recession in 2026 is elevated but still not the base case. Current projections from leading economic research firms suggest the U.S. may experience moderate GDP growth next year—generally in the 1% to 2% range.

We believe recession risk for 2026 remains contained. Should a downturn occur, most analysts expect it to be relatively shallow, supported by strong household balance sheets and available policy tools. The likely effects would include slower job creation, softer consumer spending, and tighter credit conditions.

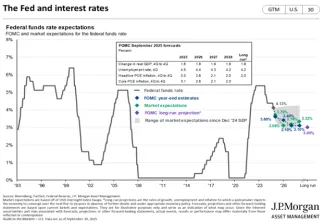

What is the FED going to do?

After several years of rate adjustments aimed at combating high inflation, and with emerging softness in the labor market, the Fed has signaled its readiness to cut rates if growth slows further. Most forecasts now anticipate at least one rate cut in 2026, as the Fed seeks to address signs of a cooling job market and support economic expansion. If recession risks materialize, the central bank could act more aggressively to mitigate the downturn.

The probability of another rate cut before year-end also remains high, positioning policy on a more accommodative path.

In addition, with a new Federal Reserve Chair expected to take office in 2026, markets may see a shift in policy tone, particularly if the incoming leadership adopts a more dovish approach to balancing growth and inflation risks.

While some volatility is always possible, runaway inflation appears unlikely in 2026.

Global Factors and Risks

International developments—including ongoing geopolitical tensions and shifting trade dynamics due to tariffs—will continue to shape the macroeconomic backdrop. Investors should also remember that unforeseen events can always alter the economic landscape.

Bottom Line for Investors

2026 is shaping up to be a year where core fundamentals—slowing but positive economic growth, contained inflation, supportive monetary policy, and ongoing AI-driven productivity gains—play a significant role in market behavior. In this environment, disciplined portfolio construction and a long-term focus remain essential.

What This Means for Your Financial Plan

Navigating uncertain conditions is nothing new for long-term investors. Ensuring that your portfolio remains aligned with your goals, risk tolerance, and time horizon is more important than attempting to react to every data point or headline.