AI Driving the Market

The equity markets' rally over the past three years has been quite impressive, to say the least. The S&P 500 Index, a proxy for the broader U.S. equity markets, is up more than 80% over that period, including an 18% gain so far in 2025.(1)

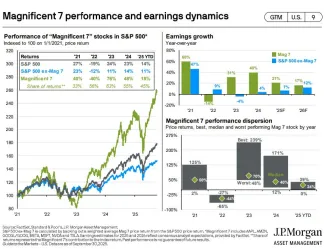

The main driver behind the recent performance has been investor optimism surrounding AI, which has fueled a surge in technology stocks, especially among the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Meta, Nvidia, and Tesla)—Mag 7. Together, these companies now represent over 35% of the S&P 500’s market capitalization, giving them outsized influence over index performance. (2)

AI-related investments by Mag 7 have surged across data centers, cloud computing, and semiconductors. Many firms are deploying AI to enhance productivity, automate workflows, and improve customer experiences. This wave of capital spending continues to ripple across sectors and helped drive strong earnings growth among the Mag 7, which continue to make substantial AI-related investments.

Chipmakers such as Nvidia, Broadcom, and Micron are seeing explosive demand as AI infrastructure spending accelerates. This reinforces the view that AI is a structural shift, not a short-term trend.

Corporate fundamentals in the U.S. also remain healthy. Profit margins have held up despite higher borrowing costs, inflation, and even recent tariffs. Solid earnings growth, real profits, and strong cash flows continue to support current valuations.

Some investors see echoes of the late-1990s dot-com bubble, questioning whether valuations are sustainable. It’s a healthy debate—but we believe today’s environment is different. Unlike the speculative companies of the dot-com era, today’s leading tech firms are profitable, cash-rich, and delivering measurable productivity gains from AI adoption.

The technology’s benefits are also visible across multiple sectors, not just within tech. AI’s influence now extends well beyond software and semiconductors. It’s transforming healthcare, financial services, industrials, and retail, helping firms streamline operations and make better decisions. Early adopters are gaining competitive advantages, while slower movers risk falling behind.

Many investors also view AI as a general-purpose technology—akin to the steam engine, electricity, or the internet—capable of driving decades of productivity growth. By automating complex tasks and enabling new business models, AI could mark a turning point for economic efficiency and output. The scale of investment underscores this conviction: trillions of dollars are being deployed into chips, data centers, and cloud infrastructure to support AI applications.

In summary, the recent rally in U.S. equities reflects both strong corporate fundamentals and investor optimism surrounding AI’s transformative potential. While valuations are high and short-term volatility is inevitable, the long-term case for AI-driven growth remains compelling. The Mag-7 have led the charge, but the next phase of this cycle will likely be defined by broader adoption across the economy.

Ultimately, the key question for investors isn’t whether AI will reshape industries—it already is—but how quickly and effectively companies can adopt it. Those that do will likely define the next decade of market leadership.

Disclosures:

Securities offered through Cetera Wealth Services LLC, member FINRA/SIPC.

Advisory Services offered through Cetera Investment Advisers LLC, a registered investment adviser. Cetera is under separate ownership from any other named entity.

- https://www.spglobal.com/spdji/en/indices/equity/sp-500/?currency=USD&returntype=T-#overview

- J.P. Morgan Asset Management, Guide to the Markets ®, 4Q2025, as of September 30, 2025