U.S. Credit Downgrade: Hype vs. Reality

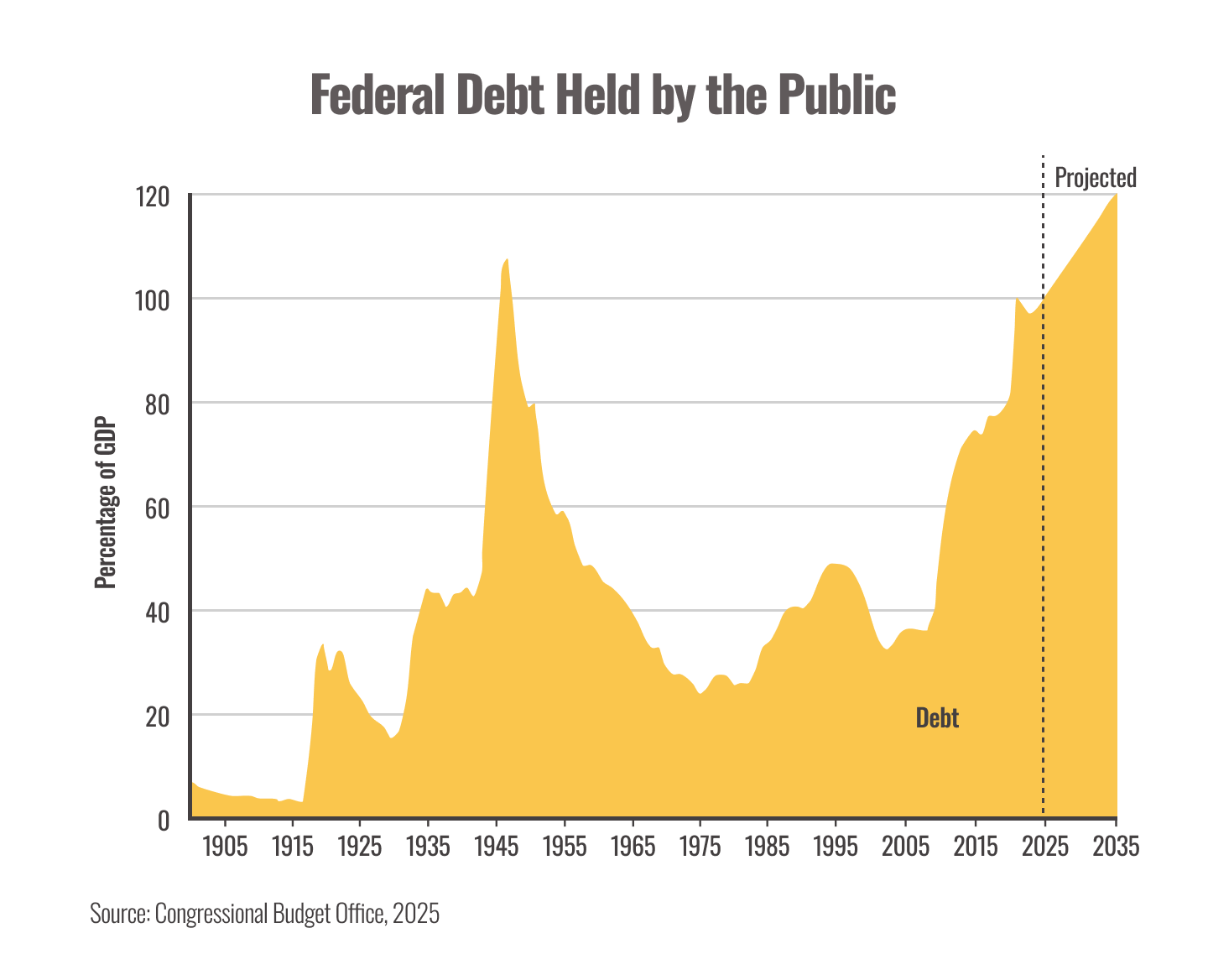

One of the world’s top credit rating agencies just made a move no one wanted to see, and the financial media took notice. Last week, Moody’s downgraded the U.S. from Aaa to Aa1.1 Their concerns? Rising debt, persistent deficits, and a lack of political will to change course. Let’s take a look at what this debt rating downgrade actually means… Think of credit ratings like a country’s credit score. For years, the U.S. had a perfect 800. High income. Clean payment history. Strong reputation. But lately, it’s like we’ve been racking up credit card debt. Income’s still solid, but lenders are starting to raise their eyebrows. That’s pretty much what happened here. While this downgrade isn't great news, it wasn’t a total shock either. Moody’s has been sounding the alarm for a while. This downgrade is a ding, not a disaster. And that seems to be how investors read the situation, too. Below shows you the trajectory of where our national debt is headed. |

|

What does this mean for you? You should have a financial plan put together by a professional that goes through the following areas - Cash Flow Planning/Retirement Planning

- Investment Planning

- Tax Planning

- Risk Management

- Estate Planning

These are the conversations we have on the regular with our clients to make sure they get the most out of our service. If you are not receiving this level of advice we FIRMLY believe you are being underserved.

Book a free 30 minute consultation below.

Sincerely, |

Sources:

|

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results. This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability, or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only. |