Government Shutdown - How This Impacts Portfolios in the Long Run

"Government Shutdown - How This Impacts Portfolios in the Long Run"

- The current government shutdown is on everyone's mind and people want to know how this may impact their portfolio

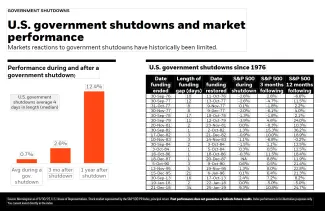

- The attached piece above from BlackRock shows an analysis of the equity market following different government shutdowns since 1976, almost a 40 year period

- In that time-period there were 20 government shutdowns (not including the current one)

- Out of those 20, the S&P 500 was down ONLY 3 TIMES the following 12 months

- The point is a government shutdown is a poor indicator of bad future market performance

- NOT that the market can't go down, but that this event doesn't mean it's imminent

- This is one type of event that the market largely "shrugs off"