Don't Let Short-Term Investments Derail Long-Term Goals

The Overlooked Risk in “Safe” Investments: Reinvestment Risk with CDs

When it comes to building and preserving wealth, one of the most overlooked risks we see is reinvestment risk—especially with Certificates of Deposit (CDs).

Many investors view CDs as a “safe” option, but here’s the issue:

- CDs are short-term instruments.

- When they mature, there’s no guarantee the reinvestment rate will be attractive.

- In today’s uncertain interest rate environment, that can lead to lower returns and missed long-term opportunities.

Align Your Money with Your Goals

Short-term needs (upcoming purchase, emergency fund)

- Use short-term investments like CDs, money market funds, or Treasury bills.

Long-term goals (retirement, education funding, legacy planning)

- Require long-term investment strategies with the potential for meaningful growth and inflation protection.

The Problem with Relying on CDs for Long-Term Money

- You risk reinvestment risk

- You face purchasing power erosion

- You miss long-term growth opportunities

Insights from MFS Research

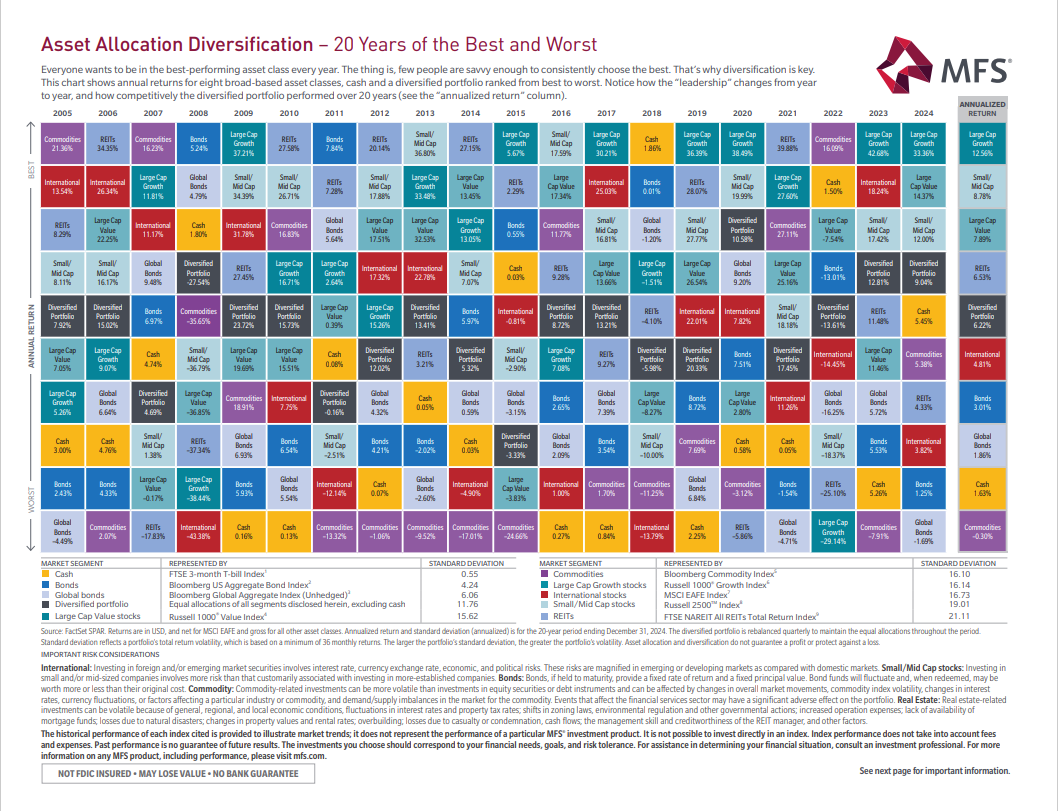

The MFS piece highlights that:

- Cash / Money Market / CD returns wildly underperform most asset classes over the long term.

- Diversified investors generate solid returns over the long term while taking on less risk.

- Equity returns are volatile in any given year, but over time, investors are rewarded for their higher average returns.

Bottom line: If you're unsure whether your investments are aligned with your timeline, we’re here to help you review your plan. Let’s make sure your money is working in the right time frame.